Betterguards products are always HSA/FSA eligible

Betterguards ankle support products are always eligible for purchase using both HSA (Health Savings Account) and FSA (Flexible Spending Account) funds. Use your HSA/FSA debit card at checkout to make a purchase using your available funds.

SHOP NOW✅ HSA/FSA ACCEPTED

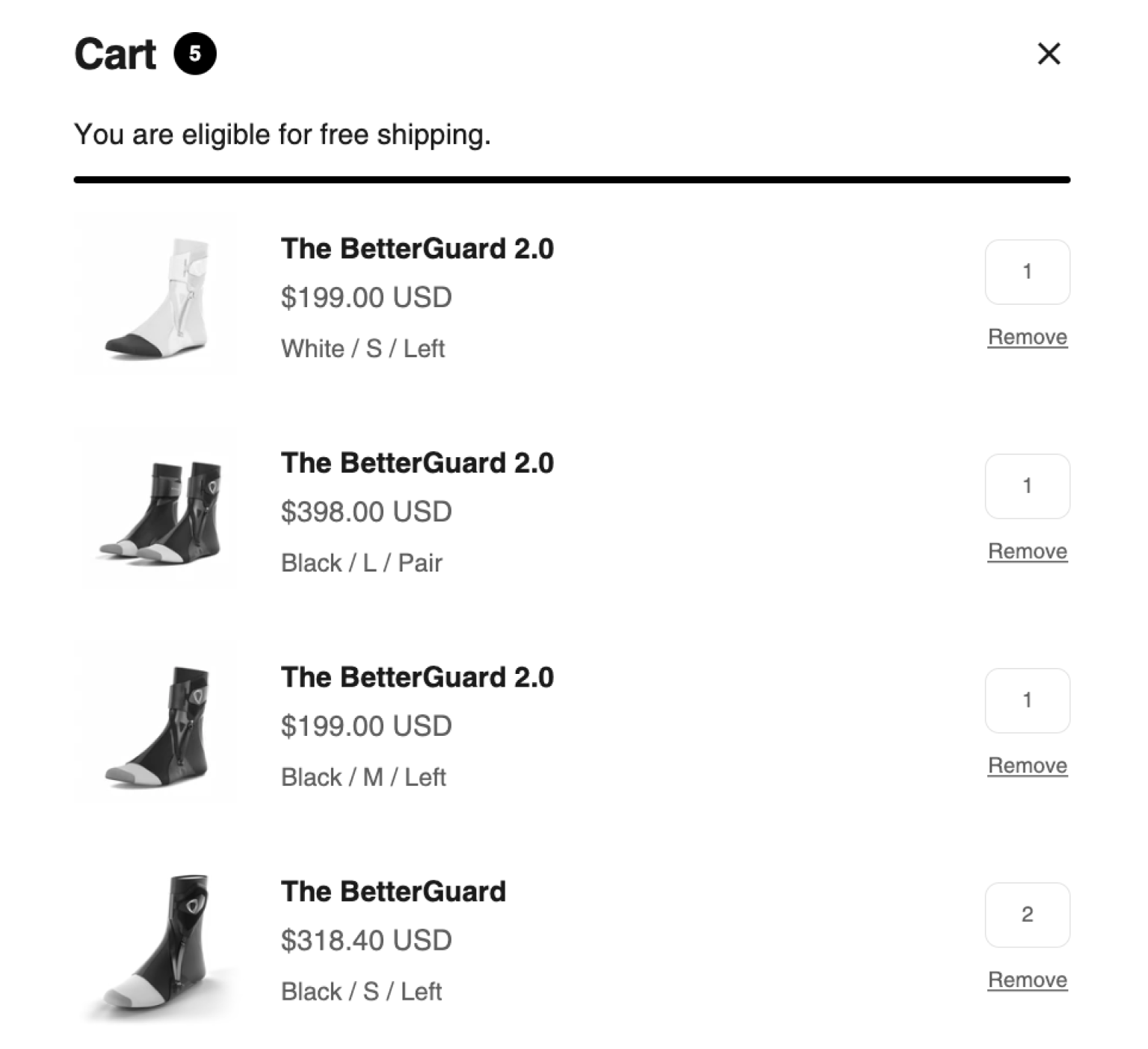

How to purchase Betterguards products with FSA or HSA funds

The BetterGuard and The BetterGuard 2.0 are always FSA/HSA-eligible items. Here's how you can purchase them using your FSA/HSA debit card in 3 simple steps:

Step 1

Add products to your cart

Step 2

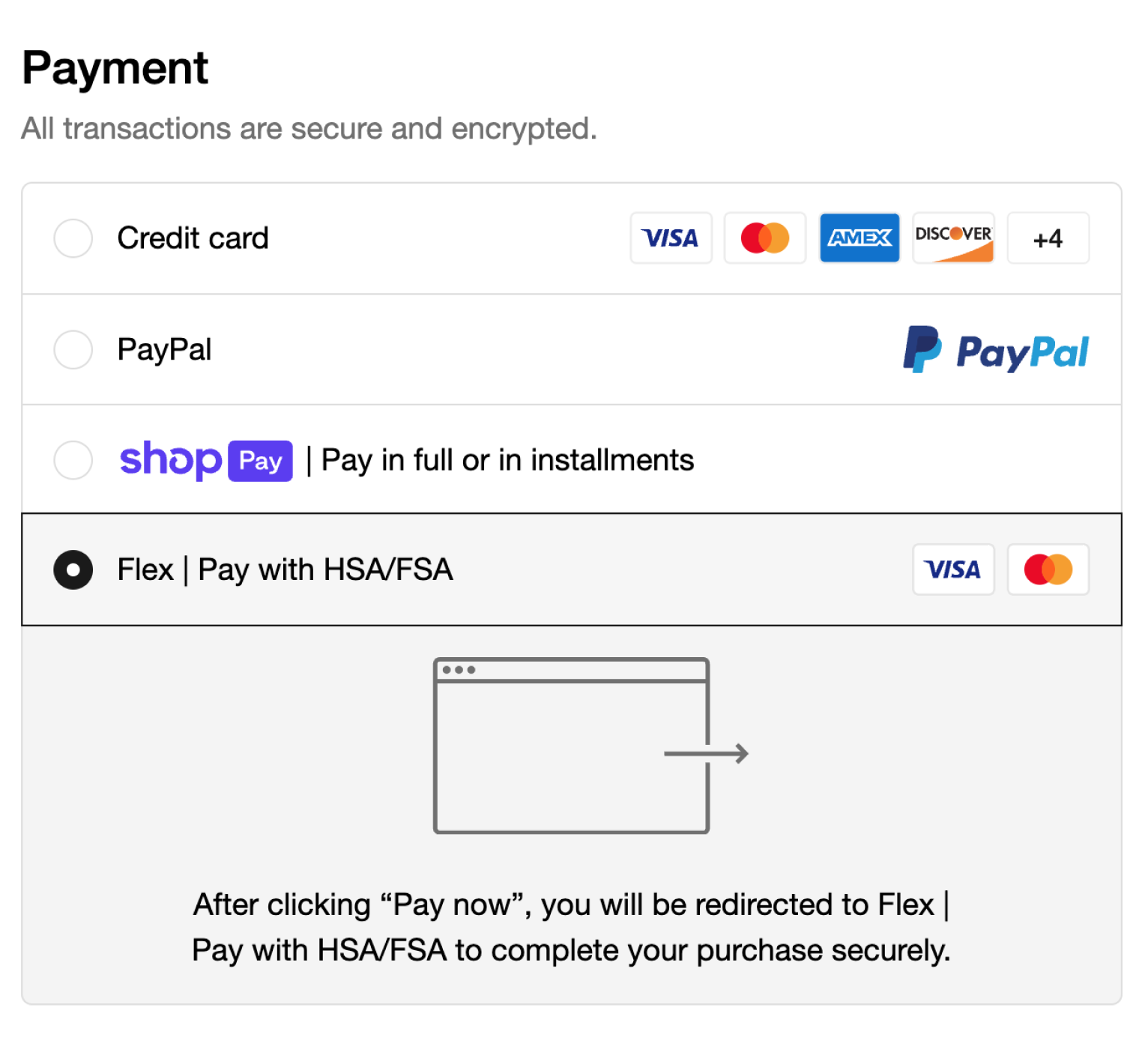

Select Flex | Pay with HSA/FSA at checkout

Step 3

Complete your purchase using your HSA/FSA debit card

HSA/FSA eligible products

Choose the best HSA/FSA eligible ankle brace for you.

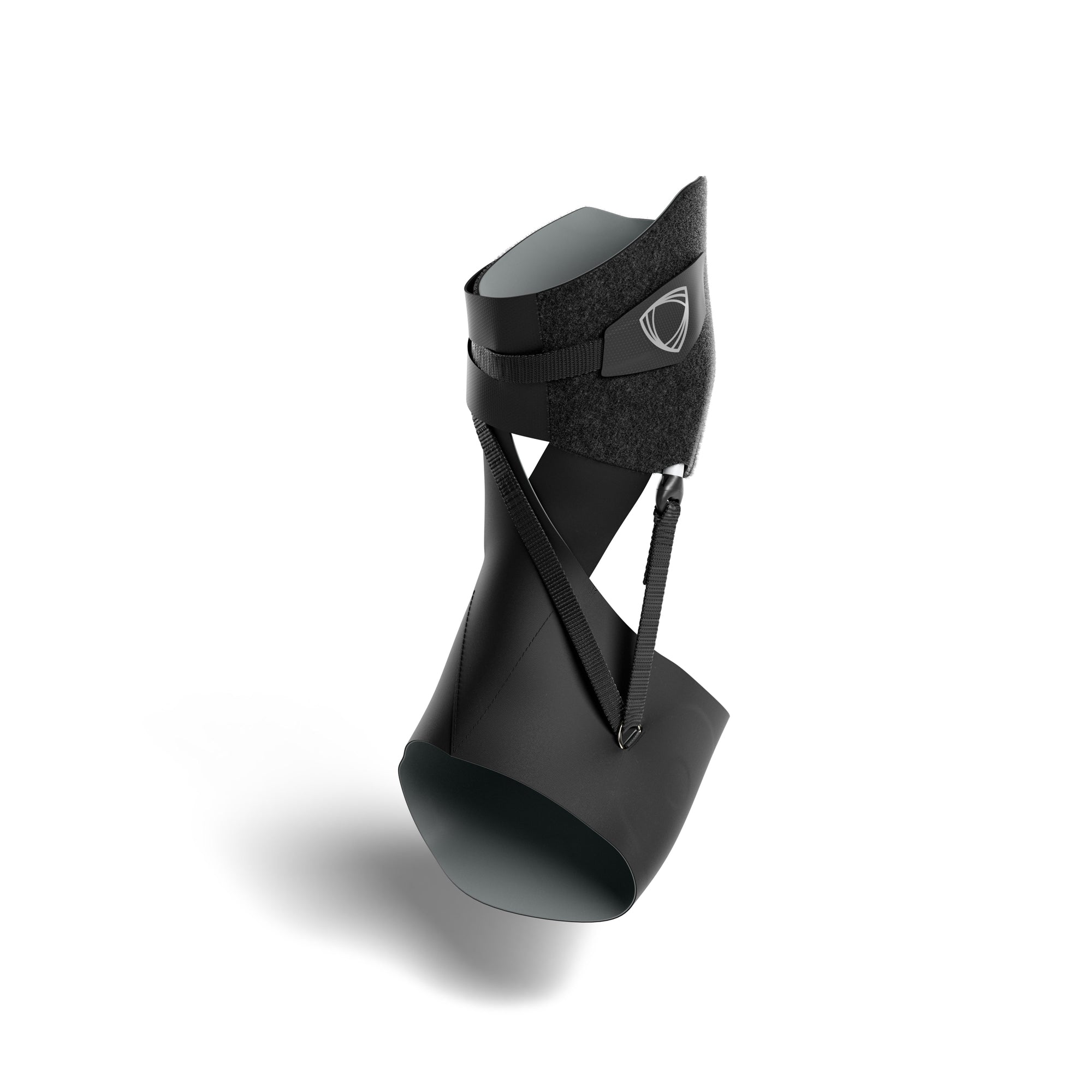

Protect your game

Experience elite ankle protection The BetterGuard. It provides critical ankle support and stability during sudden movements, helping to prevent your ankles from rolling, which could lead to severe injuries.

SHOP NOW

Recover like a pro

Speed up your recovery with The BetterGuard 2.0’s dynamic support. It maintains mobility while providing automatic ankle stabilization, reducing the risk of re-injury as you get back in action.

SHOP NOW

INNOVATION BY DESIGN

HSA/FSA eligible products backed by science, not tradition

At Betterguards, we lead with science, not tradition. We're committed to sports medicine that helps elite athletes move better and recover faster. Everything we do is safe, science-backed, and truly effective.

BEHIND THE DESIGNThe best use the best

Shop HSA/FSA eligible ankle support trusted by pro athletes

Amon-Ra St. Brown

WR, Detroit Lions

2024 NFL All Pro

Matas Buzelis

F, Chicago Bulls

Franz Wagner

F, Orlando Magic

2023 FIBA World Cup Champion

Bernard Kamungo

Forward, FC Dallas

Team USA USMNT

Casey Patterson

2016 Team USA Olympian

2021 AVP Gold Medalist

Ana Kuparev

ITF Top 500

Violet Zavodnik

Team USA Softball

2021 Gold Medalist

Mo Wagner

C, Orlando Magic

2023 FIBA World Cup Champion

Frequently asked questions (FAQs)

Find answers to your questions surrounding Betterguards' HSA/FSA eligible items

Are BetterGuards products HSA/FSA eligible?

Yes! BetterGuards products are eligible for purchase using both HSA (Health Savings Account) and FSA (Flexible Spending Account) funds, making it easy to protect your ankles while utilizing your pre-tax contributions.

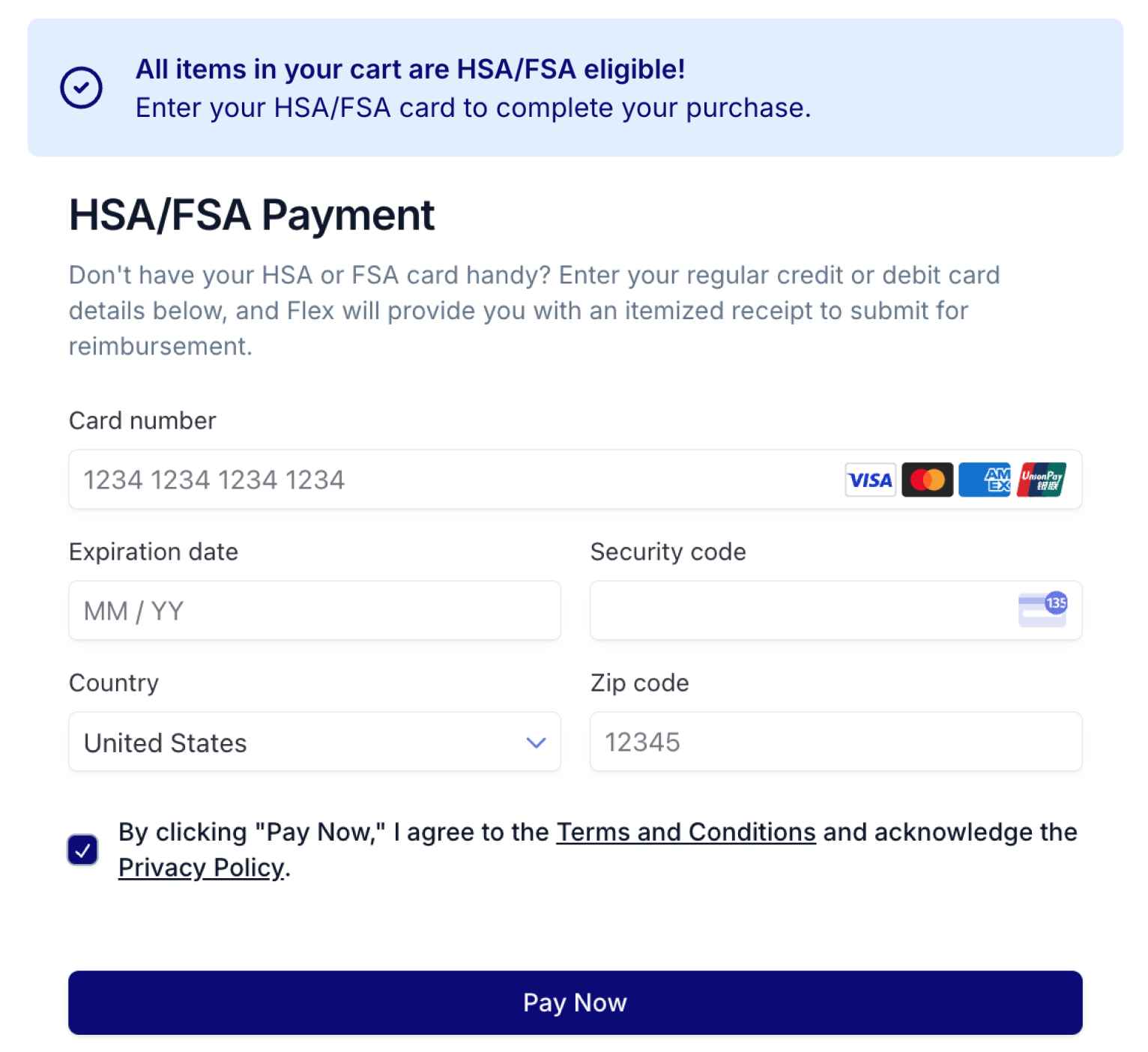

How do I pay with my HSA or FSA debit card?

To use your HSA or FSA debit card, add products to your cart as usual. At checkout, select “Flex | Pay with HSA/FSA” as your payment option, enter your HSA or FSA debit card, and complete your checkout as usual.

What if I don’t have my HSA/FSA debit card available?

If you don’t have your HSA or FSA card handy, still select “Flex | Pay with HSA/FSA” as your payment method. Enter your credit card information and you will receive an email from Flex including an itemized receipt to submit for reimbursement.

Why is my HSA/FSA card being declined?

HSA/FSA cards are debit cards, and the most common reason for declines is insufficient funds. Try reaching out to your HSA/FSA health care administrator to confirm your balance.

What’s the difference between an FSA vs HSA?

An FSA is typically provided by employers to complement your health insurance and must be used within the plan year. At the same time, a health savings account is available to supplement your health care expenses if you have a high-deductible health plan (HDHP) and allows funds to roll over from year to year. Both offer tax benefits for eligible medical expenses, but an HSA offers more flexibility long-term.

What happens to FSA funds if I don’t use them by the end of the plan year?

If your FSA does not offer a grace period or a carryover option, any unspent FSA funds will be forfeited at the end of the plan year, so it's essential to use your funds before they expire.

Is there a grace period for using FSA funds?

Some FSAs offer a grace period of up to 2.5 months to spend unused funds after the plan year ends. Check with your health plan to see if your FSA offers this feature.

How does contributing to an HSA vs FSA save me money on medical expenses?

Both HSAs and FSAs allow you to contribute pre-tax income, meaning that the money you contribute isn't subject to federal income tax, reducing your overall taxable income and helping you save on medical and health-related purchases.

Can I get a tax deduction for contributing to my HSA?

Yes, contributions made to your HSA are tax-deductible, meaning they reduce your taxable income for the year, offering significant savings on eligible expenses. However, most health savings accounts have contribution limits for qualified medical expenses, so it's important to understand your contribution amount and check with your provider if you have any questions.

What is the contribution limit for a health savings account?

For 2024, individuals can open an HSA and contribute up to $4,150, and families can contribute up to $8,300. Those age 55 or older can contribute an additional $1,000 as a "catch-up" contribution.

What eligible expenses can I pay with my HSA or FSA?

You can use HSA or FSA funds for a wide range of qualified medical expenses, including preventive care, treatments, and medical products like BetterGuards ankle protection, which help prevent injuries.

What is a Letter of Medical Necessity?

A letter is essentially a note from a doctor stating that you are purchasing an item to treat or manage a medical condition.

No other ankle support gives you more

Shop Betterguards today and experience the difference for yourself.

SHOP BETTERGUARDS